Both homeowners and businesses qualify for a federal tax credit equal to 26 percent of the cost of their solar panel system minus any cash rebates.

Federal solar rebates 2018.

Homeowners solar companies and industry advocates alike were given a big christmas gift in 2015 when congress approved the 2016 federal spending bill and extended the solar panel tax credit.

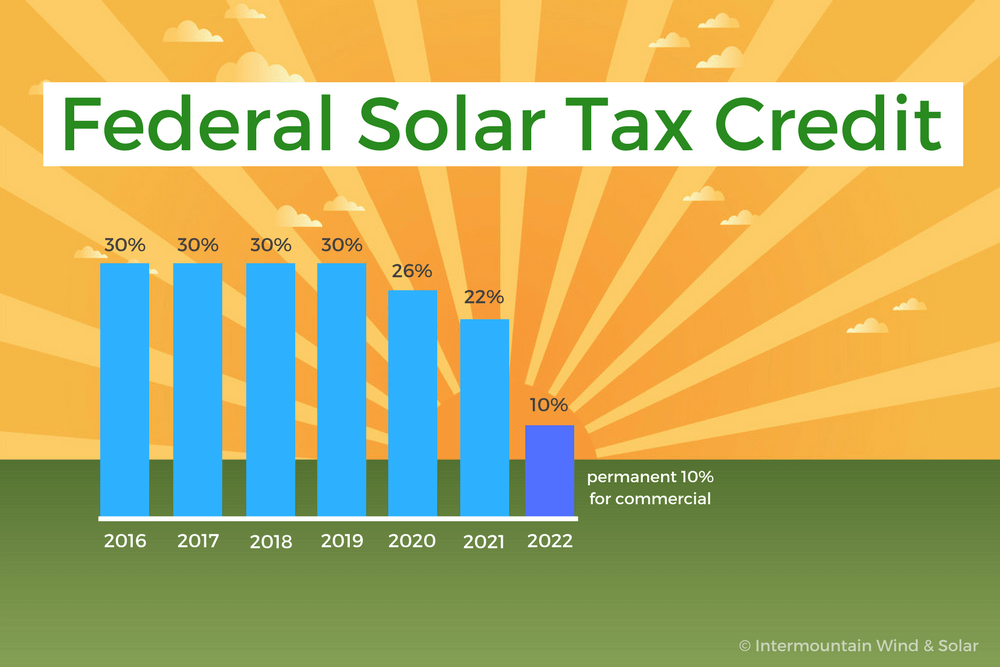

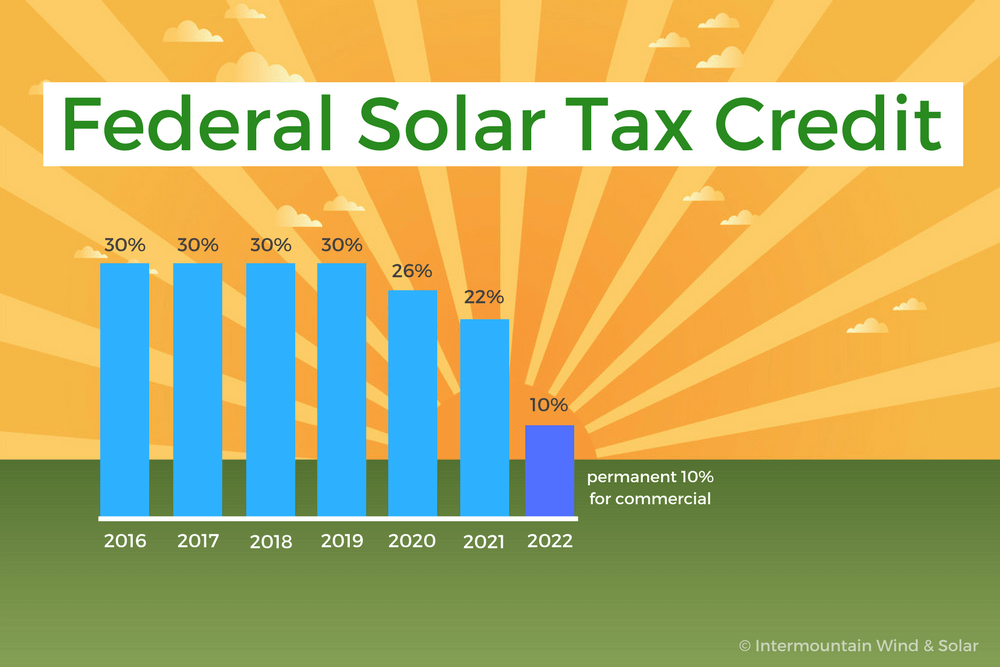

Learn more about the federal solar tax credit including the timeline for the eventual end of the itc in 2022.

Apply for power of attorney.

How to file the federal solar tax credit in 2018.

This is a guest post from sarah hancock at best company.

About publication 972 child tax credit.

Here s the value of the federal tax credit over the next five years.

These instructions like the 2018 form 5695 rev.

Filing requirements for solar credits.

One of the best incentives that comes along with a solar energy system is the solar investment tax credit itc which allows individuals who purchase a solar system to deduct 30 percent of the cost of the system from.

Households and small businesses across australia that install a small scale renewable energy system solar wind or hydro or eligible hot water system may be able to receive a benefit under the small scale renewable energy scheme sres to help with the purchase cost.

Employer s quarterly federal tax return.

The information below applies for people whose solar panel installations were fully interconnected and placed into service before midnight on january 1 2020.

February 2020 have been revised to reflect the extension of the nonbusiness energy property credit to 2018 by the taxpayer certainty and disaster tax relief act of 2019.

If say your federal taxes are 6 000 for 2020 and you re eligible for a 7 000 tax credit for installing a solar system at your house you can claim the leftover 1 000 as a credit toward your.

To claim the credit you must file irs form 5695 as part of your tax return.

You calculate the credit on the form and then enter the result on your 1040.

Some states offer additional tax credits for installing a solar.

The december 18 bill contained a 5 year solar tax credit extension which makes solar energy more affordable for all americans.

Use these revised instructions with the 2018 form 5695 rev.

If you end up with a bigger credit than you have income tax due a 3 000 credit on a 2 500 tax bill for instance you can t use the credit to get money back from the irs.

In fact the federal solar tax credit of 2020 is the final year you can claim the full 26.

Popular for tax pros.

The rest of this page applies to home solar installations completed during 2020.