Taking the eitc depends on your income obviously filing status and how many children you have and the income limits change every year.

Federal income tax credits and other incentives for energy efficiency 2018.

Here are some of the more popular credits.

Federal tax credits for new all electric and plug in hybrid vehicles federal tax credit up to 7 500.

Through the 2020 tax year the federal government offers the nonbusiness energy property credit.

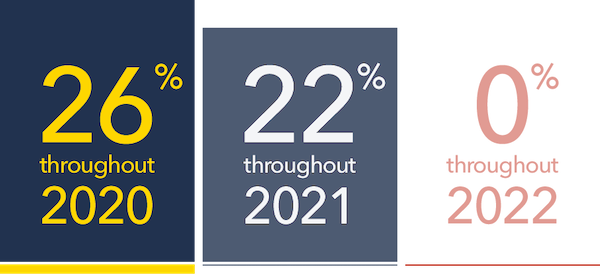

The renewable energy tax credits are good through 2019 and then are reduced each year through the end of 2021.

The tax credit for builders of energy efficient homes and tax deductions for energy efficient commercial buildings have also been retroactively extended through december 31 2020.

Energy tax breaks for 2018 2020.

Here are some key facts to know about home energy tax credits.

A law passed in december 2019 reauthorized many energy tax breaks that had expired in 2017.

Renewable energy and energy efficiency incentives.

Energy incentives for individuals.

These tax credits are valid through 2021.

It s meant to help those with modest incomes.

If a taxpayer claimed 500 or more of these tax credits in any previous year those purchases are ineligible for the a tax credit.

Federal income tax credit for energy efficiency as of february 2018 a two year budget deal has been passed that includes an extension of credits for energy e cient home improvements including purchases made in 2017.

Residential property updated questions and answers accessed feb.

Earned income tax credit.

The credit amount will vary based on the capacity of the battery used to power the vehicle.

Guarantees tax credits and other direct or indirect incentives for energy efficiency energy conservation and renewable energy rdd d.

For 2018 the limit is 15 270 if you re single with no kids 40 320 if you re single with one kid 45 802 if you re single with two.

They re retroactive to 2018 and extended through 2020 or longer.

Taxpayers who upgrade their homes to make use of renewable energy may be eligible for a tax credit to offset some of the costs.

Claim the credits by filing form 5695 with your tax return.

Tax credits for residential energy efficiency have now been extended retroactively through december 31 2020.

Federal income tax credits and other incentives for energy efficiency.

Residential renewable energy tax credit accessed feb.

Irs tax tip 2017 21 february 28 2017 taxpayers who made certain energy efficient improvements to their home last year may qualify for a tax credit this year.

They include credits for.

The programs are grouped by administering agency with references to applicable federal agency websites.

All electric and plug in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7 500.